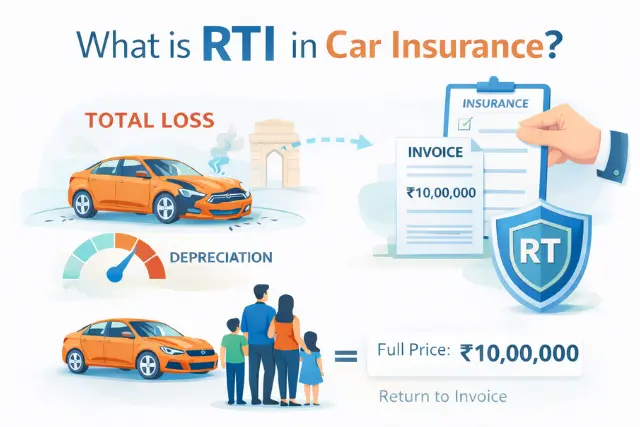

When you buy a car, you have to pay for the value of your vehicle at the time of sale. However, if you need to file a claim with your car insurance company on your car after it's been damaged or destroyed, there can be a huge difference between what you originally bought the car for and what your insurance company will pay out on your claim. This occurs because the value of your vehicle decreases each year; therefore, with the decrease in value of your vehicle, you may not be able to receive the full amount of your original purchase price when you make your claim.

What is RTI in car insurance? RTI in car insurance provides protection against this loss. If your vehicle is stolen or damaged, you can file a claim for the RTI amount and receive reimbursement for the same amount that you spent when purchasing your vehicle, without depreciation.

In order to avoid being underinsured for your vehicle and being surprised with the amount of your claim after making the claim, understanding what RTI in car insurance is can help you choose a more appropriate type of insurance to provide you with greater financial security, should you experience a large loss during a claim event of damage or theft.

What Is RTI in Car Insurance? Complete Breakdown

The answer to the question What is RTI in car insurance is, An add-on cover that is included with a comprehensive car insurance policy is often referred to as RTI (Return to Invoice). The RTI is only applicable during extreme circumstances, such as a complete loss or theft of the vehicle.

While every year, the Insured Declared Value (IDV) decreases, with the RTI cover, the insured will be compensated based on the price paid for the vehicle's original invoice.

Therefore, the amount paid for a complete loss will be closer to what the insured paid for the vehicle than what its current market value is.

RTI Full Form in Car Insurance Explained Clearly

Return to Invoice is the RTI full form in car insurance. This optional addition to car insurance policies covers reimbursements for:

- The showroom cost

- Taxes charged when the vehicle is sold

- Costs of registering the vehicle

- Costs incurred for initial insurance (as per terms outlined in the Insurance Policy).

As a result of providing these added benefits, RTI Vehicle Insurance offers greater financial security above that of standard vehicle insurance products.

RTI in Car Insurance Meaning in Everyday Language

To put it simply, RTI in car insurance meaning refers to your insurance company paying based on the value of your vehicle listed in its original papers instead of paying based on the depreciated value of a car that's several years old.

Without RTI, the amount of money you can receive when you need to file a claim progressively decreases each year. However, with RTI, if your automobile cannot be repaired and cannot be replaced, you'll receive a sum equal to what was recorded on the purchase invoice for your vehicle.

As a result of this increased clarity and certainty, many automobile owners choose to add RTI in car insurance meaning policy when purchasing a new vehicle.

When Does RTI Cover Come into Action?

RTI coverage is only applicable in the following circumstances:

- Total theft of vehicle without recovery

- Complete loss due to a collision or natural disaster

- Total repair costs exceeding 75% of the vehicle’s IDV

In such situations, the insurer will authorize the file for RTI coverage and pay claims based on the invoice value.

RTI vs Standard Claim Settlement

Aspect | Regular Insurance | RTI Add-On |

| Claim Basis | Depreciated IDV | Invoice Value |

| Road Tax Refund | No | Yes |

| Registration Cost | No | Yes |

| Best for New Cars | Limited

| Highly Suitable |

This comparison highlights why understanding what is RTI in car insurance is essential.

Who Benefits the Most from RTI Cover?

The right kind of buyer for RC insurance for car insurance includes people that are currently buying a brand-new car as well as finding a luxury or premium automobile to be bought through or financed with a loan. It is also highly recommended to people living in high risk theft areas.

For all of these individuals, RTI in car insurance means peace of mind and a higher potential payout if the vehicle is involved in an accident.

Eligibility Rules for RTI Add-On

The RTI coverage detail generally covers what has been described as:

- What you originally paid for when purchasing the car including all dealer fees associated with the sale (ex-showroom price).

- Road tax that is paid to the authorities (government) to operate your car legally on the road

- Registration fees associated with your vehicle

You have paid to add your vehicle to a policy (the first premium for your car’s insurance coverage)

What Does RTI Cover Include?

An RTI usually includes:

- Original ex-showroom price;

- taxes on cars levied by government agencies;

- registration fees

- the first year premium for automobile insurance (where applicable).

When RTIs are used by motor vehicle owners, they provide broad coverage of the circumstances surrounding their automobiles and increase the protection afforded to the owners through the RTI.

What RTI Add-On Does Not Cover

RTI is not applicable to the following items:

- Injuries or damages that are minor or partial

- Mechanical or electrical failures

- Damage to an engine

- Accessories that were installed after purchase

RTI is only for vehicles declared a total loss.

Cost of Adding RTI to Car Insurance

With respect to premiums, the RTI add-on typically raises your premium by 5% to 10%. However, when you consider that the depreciation you save from an RTI add-on is much greater than the premium increase.

It is a relatively inexpensive way to protect yourself from large financial losses.

Key Advantages of RTI in Car Insurance

- No depreciation at claim time

- Largest claim payout

- Easy to pay off your car loan

- Great for first-time buyers.

Now you know exactly what RTI means with regard to windscreens, understanding what is RTI in car insurance means maximising your insurance value.

Conclusion

Now that you understand what is RTI in car insurance, Use of RTI, or Return to Invoice, coverage is important to recover the original purchase price of your vehicle if you lose it in a significant way. Vehicles depreciate quickly, and the benefit of RTI coverage is particularly useful for new and high value vehicles.

Frequently Asked Questions (FAQs)

1. What is RTI in car insurance?

RTI in car insurance is an add-on that pays the original invoice value of your car in case of total loss or theft.

2. RTI full form in car insurance?

RTI stands for Return to Invoice.

3. RTI in car insurance means what exactly?

It means getting the original purchase value instead of depreciated IDV.

4. Is RTI mandatory in car insurance?

No, RTI is optional but highly recommended for new cars.

5. Can old cars get RTI cover?

Most insurers allow RTI only for cars up to 3–5 years old.

6. Does RTI apply to partial damage claims?

No, RTI is applicable only in total loss or theft cases.